This article describes research on a new test

that is included in the Conscious Investor Investment System.

The result is that we can provide earnings forecasts on

selected stocks that are five times more accurate than the

average of analysts' forecasts.

In the long run, the value of a stock is the

discounted value of the cash that can be taken out of the

company during its remaining life. The usual analysis requires

two inputs. Firstly, a forecast of how much cash the company

is going to generate year by year. This is generally written

as a percentage growth rate starting with the current cash.

Secondly, a rate at which this cash should be discounted.

There are two extra ingredients that are often

pushed to the background. The first is what do we mean by

the cash that can be taken out of the company. The simple

answer is the earnings. A better answer is one of the variations

of free cash flow. I’ll talk about this in a later

article. To keep things straightforward, here I will just

use earnings.

The second extra ingredient is confidence.

How confident are we with the earnings forecasts? I have

seen investors' eyes glaze over as they started imagining

the yacht they were going to buy. They had found a stock

and forecast its earnings to grow at 30% per annum. The

market had missed it and now our starry-eyed investors were

ready to make a killing. Alas, even though this was the

forecast, what are the odds of it being accurate?

First, lets consider how well the professional

do. In 1997 Lawrence Brown published a study in the Financial

Analysts Journal looking at 130,000 forecasts by analysts

from 1985 to 1996. He found that the average absolute error

was a whopping 91.6 percent.

The difficulty is that analysts are starting

behind the eight ball. They are assigned a group of companies

and told to forecast their earnings. Unfortunately the earnings

of companies such as Chiquita Brands and the Venator Group

have more ups and downs and twists and turns than The Beast

roller coaster in Cincinnati.

But we do not have this problem. No one tells

us which companies to analyze. We have 10,000 companies

to choose from so why not turn the problem around and focus

on those companies about which we can have confidence?

One way to do this is to eyeball the historical

earnings of companies and pick out those companies with

earnings that grew smoothly. Next, extrapolate the data

for these companies to forecast future earnings. This works

to some extent, but I wanted to automate the selection/forecasting

process.

This is where STAEGR™ enters, a new test

I developed for my investment software Conscious Investor.

It measures the stability of earnings growth from year to

year and expresses it as a percentage. The maximum figure

of 100% represents earnings that go up, or down, by the

same percentage each year. The calculations are based on

fitting an exponential curve to the historical data with

more emphasis on the stability of the growth of recent earnings.

Special adjustments are made for negative earnings, for

extreme outliers, and for earnings near zero.

Using Value Line data, I considered all the

companies with eleven years of earnings data from 1988 to

1998 inclusive. Next I divided the companies into ten groups

ranging from those with the highest STAEGR over the ten

years from 1988 to 1997 to those with the lowest STAEGR

over this period. Each group contained 115 companies.

The next step was to calculate the earnings

growth over the ten-year period using another Conscious

Investor function. Earnings in 1998 were forecast using

1997 data and this historical growth figure. Finally the

forecasted earnings were compared with the actual earnings

in 1998.

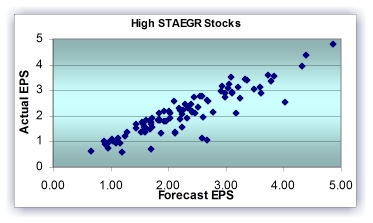

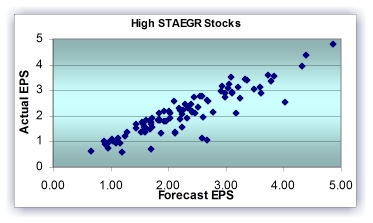

The result of most interest to

us was that the forecasted earnings of the high STAEGR group

were extremely accurate. For the technically minded, the

forecasted earnings explained 98 percent of the variation

of the actual earnings. This can be seen in the accompanying

chart.

The points represent the earnings figures,

forecast and actual, of the companies in the group. Most

of the points lie on or near a straight line which means

that actual earnings were very close to the forecasts using

historical earnings. The STAEGR of this group of 115 companies

was 93% and up.

Another way of describing the results is that

the average absolute error for this group of was 16 percent

compared to the analyst error of 91.6 percent for all stocks.

The difference is even more significant than it appears

since the forecasts for the STAEGR method were for a full

year whereas those of the analysts were only for the next

quarter.

The results for the second group of stocks

was similar. Their STAEGR ranged from 90% to 93%. This means

that when we focus on stocks with the highest levels of

STAEGR, say 90% and up, then the past growth or earnings

is a statistically reliable predictor of earnings for the

following year.

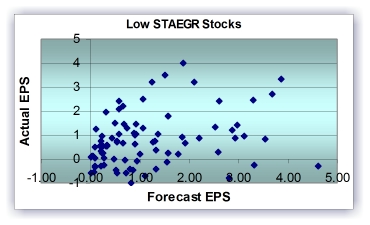

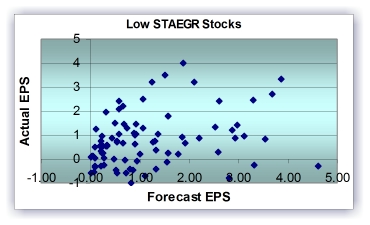

The accompanying chart shows the data for

group of stocks with the lowest STAEGR.

In contrast, to the previous chart, clearly

the dispersion of the data points is much higher. Notice

that for some of the points the forecast is negative while

the actual earnings are positive and for other points the

opposite holds, positive forecasts resulting in negative

outcomes.

The way these points are scattered is typical

of the groups of stocks with lower STAEGR. In each case,

the accuracy of the predictions using historical data was

lower in two ways. Firstly the data points were more dispersed.

Secondly the line of best fit had slopes further away from

1 and in many cases it was negative.

The study shows that you can have more confidence

that earnings will continue to grow as in the past for stocks

with a high level of STAEGR.

Of course, just because we have confidence

in our forecasts of future earnings of a company does not

mean that we should rush out and buy it. But it does provide

a solid basis for any buy/sell/hold analysis. Sorting stocks

with the high levels of STAEGR for earnings as well as sales

is another of the unique features of Conscious

investor.

|