Greg

Beckett, the founder of the Richmond Club, recently interviewed

Ed Kelly on how he got started with Conscious Investor and

some of the results from his research into it as an investment

tool. Also see the comments by Professor John Price on Ed

Kelly's research. [click here] Greg

Beckett, the founder of the Richmond Club, recently interviewed

Ed Kelly on how he got started with Conscious Investor and

some of the results from his research into it as an investment

tool. Also see the comments by Professor John Price on Ed

Kelly's research. [click here]

Greg Beckett: Who are you

and what is your background?

Ed Kelly: My name is Edward

Kelly, I am 44, married with 4 small children and I live

in Dublin, Ireland. I have a BA and an MBA. I am currently

completing a Masters degree (MLit) in finance at Trinity

College and plan to do a PhD on Warren Buffet and Conscious

Investor. My business background can be divided into two

streams, successful ones and non-successful ones. The successful

ones are two periods of time where I set up and ran my own

business, one for profit, the other a non-profit (i.e. 10

of the last 17 years) and the non-successful ones (4 of

the last 17 years) where I worked for other people. The

remaining time was spent studying. It seems I seem to do

better on my own. In the business sense, I could be described

as an entrepreneur in the medium to strong form.

GB: How did you get started

with Conscious Investor?

EK: I came to Conscious Investor

through reading about Warren Buffet. Back in 1993, I had

a plan to raise $100,000 and start an investment fund following

the Buffet approach to investing. However, I could not create

the investment macros in Excel which were necessary to analyze

the numbers, i.e. returns on equity, growth in earnings

etc. Anyway, I got diverted into a new business, made quite

a bit more than $100,000 and then blew most of it in non-Buffet-like

investments in the late 1990’s.

Then one day in 2002, licking my wounds, I

came across Conscious Investor on the Sydney Morning Herald

website. Wow! Here was the product I needed and wished I

had back in 1993! Now someone with real credibility had

developed the software that would do all the number crunching

for me, leaving me to make the decisions on what I wanted

to invest in. An opportunity seemed to be emerging. I thought,

this is great; I can now set up a fund and start investing

like Warren Buffet. As it happened, I was coming to the

end of a 7 year cycle with my business and I was bored and

needed a change? Maybe this could be achieved with Conscious

Investor?

GB: What do you like about

it?

EK: I can’t praise

the product highly enough. To be honest, I have not compared

it with other products in the market; I don’t need

to, as it has all I need. Even if I did, I imagine it would

score very highly, assuming there is something else like

it out there. It is incredibly powerful. If you think about

it, using a long-term conservative approach to stock selection,

you can analyze 6,000 US stocks and eliminate 99.9% of them

in minutes. This leaves a small number of ‘great performing’

stocks that can then be analyzed in detail. The kind of

investing we are talking about, i.e. using ‘excess

capital’, i.e. those funds that you have left over

as savings needs to be invested wisely and for the long

term. The other thing I like about Conscious Investor, and

this is more to do with the overall Conscious Investor approach,

is the emphasis on linking both sides of your brain while

making an investment decision. I.e. the analytical side

and the emotional side. I am sure that this is where the

real skill lies with Buffet and his partner Charlie Munger.

I don’t think Conscious Investor answers all the questions

here, but it does go someway to raise the importance of

knowing what kind of investor you are. Controlling the voices

in your head must lead to greater clarity of thought!

GB: Why did you decide to

undertake a research study?

EK: It was confluence of

events. Firstly, I came across Conscious Investor at the

right time as I was coming to end of a cycle in my business.

Secondly, for almost ten years I have been reading about

Warren Buffet and wanted to learn to invest like him. Thirdly,

I thought at the back of my mind that there might be an

opportunity to be involved with the development of Conscious

Investor in Europe. However, I wasn’t prepared to

get involved in selling something, even if such an opportunity

arose, as important as an ‘investment methodology’

until I fully understood it myself and more importantly,

fully believed in the credibility of the product. So, I

thought I will take some time off, head for the nearest

University (ten minutes walk from my house) and start back

testing the Conscious Investor approach on the US stock

market.

GB: What are some of initial

findings?

EK: I have conducted three

studies so far, the most important and advanced one of which

is the S&P 100 study (1993-2003). This might take a

bit of time, but please bear with me, as the results are

interesting. I should say that doing a ‘retrospective

study’ is peculiarly difficult. For instance, if I

picked Wal-Mart back in 1993 because I thought it had strong

earnings growth potential, I could be accused of bias aforethought,

i.e. I knew it would do well. So to avoid accusations of

bias, I ended up simply applying a set of Conscious Investor

default settings to the S&P 100 in 1993 and buying all

those stocks that passed the defaults, and at the price

quoted on the market at that time, i.e., no margin of safety.

Also, getting accurate and consistent data over 20 years

proved difficult, hence the ‘paired down’ Conscious

Investor default settings/financial hurdles used.

These results are impressive. They show an

inefficient market which is not what is expected from standard

finance theory. What I can say for sure is that if you were

to invest in the S&P 100 in 1993 and if you were to

invest in a portfolio using the Conscious Investor default

settings as applied in this study you would have outperformed

the S&P 100 over ten years by 99%.# And further,

if you increased the financial hurdles in selecting your

stocks in 1993, you would have outperformed the S&P

100 over ten years by 200%.

An amount of $1m invested in a portfolio using

the increased financial hurdles in Conscious Investor in

1993 would have grown to over $4m in 10 years. In contrast,

$1m invested in the S&P100 over the same period of time

would have grown to around $2.4m.

Overall the Conscious Investor portfolio had

an average annual return of 17.13 percent compared to 10.22

percent for the S&P 100.

GB: How have people reacted

to your results?

EK: I have to say that I

had little knowledge of what I was letting myself in for.

The minute I showed these results to the academic community

in the College and told them of my desire to study Warren

Buffet, they were taken aback. Did I not know that the market

was efficient? Did I not know that you can’t predict

future price movements and that the only sensible way to

manage a portfolio was through diversification? I was accused

of all sorts of heresies and that my work was really of

an undergraduate standard! At one stage, one fellow PhD

student (on a grant) told me “my work lacked academic

credibility”. I said what! He said, “your works

lacks any academic framework”. I replied, “Here’s

a framework. You are down to your last $1,000 and you have

Warren Buffet and Professor Efficient Markets in the room,

who do you give your $1,000 too?” Stunned silence.

“Well,” I said, “the rational answer is

Warren Buffet because over the last 37 years, he has generated

an annual return of 22% and Mr Efficient Markets has done

no better than 10%.

However, to be fair to the PhD student he

did me a favor. If Conscious Investor, and more to the point,

my research, is going to stand up in the academic community

and to a lesser extent in the broader market, it can only

benefit from being framed within the context of modern finance

and investment theory. At least we will know who the competition

is!

GB: How would you like to

extend the study?

EK: Once I have managed to

fend off the Efficient Markets police, assuming I can do

that which is really up to the data, I mean it works or

it doesn’t, I would like to extend the study to different

time periods and different data sets. After that I want

to find a way to test the non-financial aspects of the Conscious

Investor approach, i.e. economic moat, management and so

on. This is what might be called the ‘Charlie Munger’

(Buffet’s partner) side of the house. This is a much

more challenging area to model, particularly retrospectively.

My thoughts are to somehow come up with a Human Capital

Index which rates companies for the quality of the management

and their execution of their strategy. This would include

areas such as:

- Is the business simple and easy to understand?

- Does the business have a competitive advantage

or economic moat?

- Does management have a clear unambiguous

strategy and are their decisions in line with the strategy?

Charlie Munger is getting increasing attention

for his contribution to the success of Berkshire Hathaway.

He seems particularly interested in the human capital side

of the business and says one of the things that he and Warren

like to do is marvel at the misjudgments of people. Charlie

Munger has spoken of the “24 Standard Causes of Human

Misjudgment” which I would like to look at in more

detail, particularly as they apply to investment decisions.

However, by its very nature, the non-financial side of business

analysis is much more subjective and thus more difficult

to model so I am not sure how this will turn out. However,

to learn you must go from the known to the unknown!

Appendix: Research Results

This is part of the technical study in which

a set of Conscious Investor financial hurdles (see Table

1) were applied to the Standard & Poor’s 100 index

(S&P 100) in 1993. Of the 100 S&P stocks, 18 stocks

passed the financial hurdles. These 18 stocks were then

grouped into a portfolio called The Conscious Investor Portfolio

(CI Portfolio). The performance of the CI Portfolio was

then compared with the S&P 100 from 1993-2003 (ten years).

No attempt was made to understand the businesses,

nor was any attempt made to buy these stocks building in

a margin of safety. All 18 stocks were bought in June 1993

and sold again in June 2003. The key financial hurdles were

as follows:

|

Table

1- Conscious Investor Financial Hurdles |

|

Number |

Parameter |

Minimum Level |

1 |

Financial history |

10 Years |

2 |

Return on Equity (ROE) |

10% |

3 |

Earnings per Share HGROWTH |

10% |

4 |

Earnings per Share STAEGR |

70% |

|

Ten years financial data was deemed necessary

to provide a clear picture of the historical performance

of each stock. The required ROE level was set at 10%. The

HGROWTH1 in EPS hurdle, i.e. the historical growth

of the earnings per share over the previous ten years, was

also set at 10% and the stability of the EPS, i.e. STAEGR2

was set at a minimum of 70%.

While 10% was the minimum ROE requirement,

the average ROE for the 18 stocks selected was 21.5%. Also,

while the minimum HGROWTH in EPS was also 10% whereas the

average HGROWTH in EPS for the 18 stocks was 18.8%. Similarly,

the minimum STAEGR in EPS was 70-80% while the average for

the 18 stocks was 87.9%. Of the original 100 stocks, only

76 had ten years financial data. Of those 76, 57 met the

ROE requirements, 30 met the historical HGROWTH in EPS requirement

and 33 met the stability or STAEGR in EPS requirements.

However, only 18 companies met all four requirements together.

(See Table 2).

|

Table

2 - Conscious Investor Portfolio |

|

Number |

Company |

10 Years |

ROE |

EPS HGROWTH |

EPS STAEGR |

1 |

Altria GP |

Yes |

31% |

21%

|

85% |

2 |

Amer Intl GP |

Yes |

13% |

19% |

77% |

3 |

Anheuser-Busch |

Yes |

14% |

11% |

82% |

4 |

Bank One |

Yes |

16% |

12% |

97% |

5 |

Boeing |

Yes |

14% |

16% |

75% |

6 |

Coca Cola |

Yes |

48% |

18% |

96% |

7 |

General Electric |

Yes |

17% |

11% |

88% |

8 |

Heinz |

Yes |

23% |

13% |

93% |

9 |

Home Depot |

Yes |

16% |

43% |

90% |

10 |

Johnson & Johnson |

Yes |

32% |

18% |

80% |

11 |

Limited Brands |

Yes |

20% |

23% |

83% |

12 |

McDonalds |

Yes |

18% |

13% |

97% |

13 |

Medtronic |

Yes |

25% |

17% |

92% |

14 |

Merck |

Yes |

22% |

23% |

87% |

15 |

Pepsico |

Yes |

25% |

22% |

82% |

16 |

Raytheon |

Yes |

16% |

11% |

94% |

17 |

Toys R Us |

Yes |

15% |

19% |

90% |

18 |

Wal-Mart |

Yes |

23% |

30% |

93% |

|

Average |

Yes |

21.5% |

18.8% |

87.9% |

|

Many of the 18 stocks in the CI Portfolio

are household names which is not surprising as the S&P

100 is made up of some of the largest and best know companies

in the US and worldwide. After ten years, $1m invested in

the CI portfolio was worth over $3m, a return of over 200%.

A corresponding amount invested in the S&P 100 was worth

just over $2m, a return of 100%.

During the first six years (i.e. from 1993-1999)

the performance of the CI Portfolio was slightly better

than the S&P 100. But when the market came off its ‘irrational

exuberance’3 of the late 1990’s that

the CI Portfolio substantially outperformed the S&P

100.

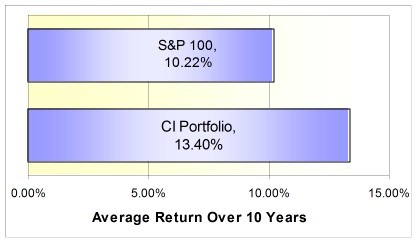

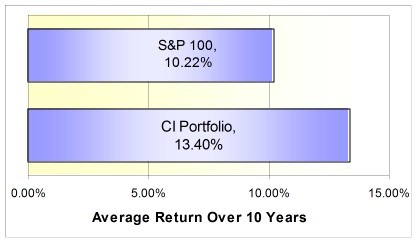

Overall the Conscious Investor portfolio had

an average annual return of 13.40 percent compared to 10.22

percent for the S&P 100.

Figure 1 - Conscious

Investor Performance

The performance of the CI Portfolio,

at least in academic terms, needs to be considered in the

context of the dominant paradigms of modern finance, i.e.

the Random Walk Theory (RWT), the Efficient Markets Hypothesis

(EMH) and Modern Portfolio Theory (MPT).

The RWT asserts that the past

performance of a stock price has no bearing on future stock

performance, i.e. stock prices have no memory.

The EMH says that all information

on a stock is contained in the current stock price which

is the best estimate of the stock’s fair value.

MPT says that you can’t

outperform the market without taking greater than market

levels of risk (as defined by volatility, size and value)

and that risk, at least the risk of any one stock in relation

to the market, can be reduced or eliminated by diversification.

It is fair to say, that these

theories form the intellectual basis, through index fund

investing, for at least 40% of the investments in the market

today. A considerable amount of time in this study is devoted

to framing the results of the study within the above paradigms.

During the final stage of the study, the Conscious

Investor financial hurdles were increased. The objective

was to see what impact, if any, would occur if the financial

hurdles in Conscious Investor were increased and applied

to both the existing CI Portfolio and the original list

of 100 S&P 100 stocks. A total of 17 different portfolios

were considered using a range of Conscious Investor financial

hurdles. 16 portfolios outperformed the S&P 100 of which

nine portfolios out-performed the S&P 100 without selecting

Medtronic (the star performer in the original CI Portfolio)

and nine portfolios out-performed the original CI Portfolio.

Only one portfolio failed to outperform the S&P 100.

The increased financial hurdles were as follows:

|

Table

3 - Increased Conscious Investor Financial Hurdles |

|

Number |

Parameter |

Minimum Level |

1 |

Financial history |

10 Years |

2 |

Return on Equity (ROE) |

20% |

3 |

EPS HGROWTH |

15% |

4 |

EPS STAEGR |

70% |

|

The ROE was increased from a minimum 10% to

20% and the HGROWTH in EPS from a minimum of 10% to 15%.

The STAEGR in EPS level stayed the same at 70%. Instead

of selecting 18 stocks, the IFH 4 portfolio selected seven

stocks. Theses seven stocks outperformed the S&P 100

by over 200% and the original CI Portfolio by more than

200%.4

|

Table

4 - Conscious Investor Portfolio

with Increased Hurdles |

|

Number |

Company |

10 Years |

ROE |

EPS HGROWTH |

EPS STAEGR |

1 |

Altria GP |

Yes |

31% |

21%

|

85% |

2 |

Coca Cola |

Yes |

48% |

18% |

96% |

3 |

Johnson & Johnson |

Yes |

32% |

18% |

80% |

4 |

Limited Brands |

Yes |

20% |

23% |

83% |

5 |

Medtronic |

Yes |

25% |

17% |

92% |

6 |

Merck |

Yes |

22% |

23% |

87% |

7 |

Wal-Mart |

Yes |

23% |

30% |

93% |

|

Average |

Yes |

29% |

21% |

85% |

|

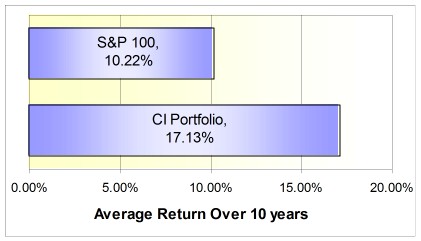

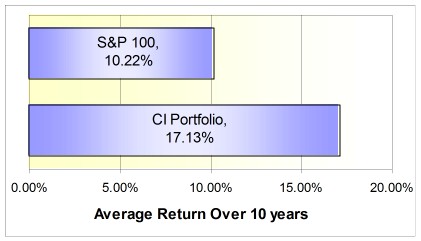

So in this case, it was possible to double

the performance. The actual average annual returns are shown

in the next figure.

Figure 2 - Performance

of Second Conscious Investor Portfolio

These results are impressive.

They are showing an inefficient market which is not what

is expected. I now have to run statistical tests on the

results to show whether or not we could have got such results

from chance

My own sense is that it is too

early to say with any certainty whether the results are

of any real value. But what I can say for sure is that if

you were to buy a set of stocks from the S&P100 in 1993

using the Conscious Investor default settings as applied

in this study you would have outperformed the S&P 100

over ten years by 99%. And further, if you increased the

financial hurdles in selecting your stocks in 1993, you

would have outperformed the S&P 100 over ten years by

more than 200%.4

Comments

by Professor John Price: It is exciting

to see more and more independent validation of what we have

been working on at Conscious Investor for many years. I would

like to add two points. The first is that Ed Kelly's results

were obtained using only a part of the total Conscious Investor

approach. The full approach also considers the companies involved

in terms of such things as their products and services and

their economic moat. In other words, what makes them special

in regard to consumers and their competition. The

second point is that the Conscious Investor portfolio was

selected back in 1993 and then held for 10 years. No further

stocks were added or removed over that time.

We don't recommend this. It is

only common sense to monitor your portfolio, even if only

minimally. But even if you do use Conscious Investor to

buy a portfolio of stocks and then just forget about them,

this study shows that the Conscious Investor portfolio still

outperformed the market by a considerable amount.

Footnotes

1) "HGROWTH is a proprietary

function in Conscious Investor that calculates the average

annualized growth rate of a sequence of data. The function

is based on the calculation of an exponential curve that

is best fit to the given data. Special adjustments are made

for negative data, for extreme outliers and for earnings

near zero. The rate returned by HGROWTH is the annualized

growth curve of this curve”. Prof John Price Conscious

Investor Manual 2000.

2) "STAEGR is the function

that measures the stability or smoothness of the growth

in earnings and sales and is a partner to HGROWTH. HGROWTH

measures how fast the earnings or sales are growing while

STAEGR measures how smoothly this growth is taking place.

The function STAEGR measures the stability of the growth

of historical data from year to year as a percentage. This

data can be any sequence of numbers. Its purpose in Conscious

Investor is to measure the stability of earnings and sales

per share. The maximum figure of 100% represents data that

goes up or down by the same percentage each year. The calculations

are based on fitting an exponential curve to the historical

data with more emphasis placed on the stability of the growth

of recent earnings. Special adjustments are made for negative

earnings, extreme outliers and for earnings near zero”.

The calculations also require at least three years of earnings.

Prof John Price Conscious Investor Manual 2000

3) US Federal Reserve Chairman,

late 1990’s referring to the stock market. See also

Robert Shiller’s book “Irrational Exuberance

”.

4) A return of 10.22% per year

(the S&P100) means a total return of 164.60%

over 10 years and a return of 17.13% (the Conscious Investor

portfolio) per year means a return of 386.05% over the same

eriod of time. Hence the Conscious Investor portfolio out

performed the S&P by 221.45%.

Disclaimer:

Conscious Investing provides general advice

and information, not individually targeted personalised

advice. Advice from Conscious Investing does not take into

account any investor’s particular investment objectives,

financial situation and personal needs. Investors should

assess for themselves whether the advice is appropriate

to their individual investment objectives, financial situation

and particular needs before making any investment decision

on the basis of such general advice. Investors can make

their own assessment of the advice or seek the assistance

of a professional adviser.

Investing entails some degree of risk. Investors

should inform themselves of the risks involved before engaging

in any investment.

Conscious Investing endeavours to ensure accuracy

and reliability of the information provided but does not

accept any liability whatsoever, whether in tort or contract

or otherwise, for any loss or damage arising from the use

of Conscious Investing data and systems. Past performance

is not necessarily indicative of future results. Information

and advice provided here is not an offer to buy or sell

securities. View

the full Disclaimer. |

Greg

Beckett, the founder of the Richmond Club, recently interviewed

Ed Kelly on how he got started with Conscious Investor and

some of the results from his research into it as an investment

tool. Also see the comments by Professor John Price on Ed

Kelly's research. [

Greg

Beckett, the founder of the Richmond Club, recently interviewed

Ed Kelly on how he got started with Conscious Investor and

some of the results from his research into it as an investment

tool. Also see the comments by Professor John Price on Ed

Kelly's research. [