Conscious

Investor

... now with the

Conscious Investor Wizard |

|

Fourth Generation

Investment Software

“It’s like having

your own personal investment expert in your computer.”

Investment software has come a long way from

its origins as a “number crunching” tool to

implement various stock analysis and evaluation functions.

Conscious Investor, which now includes the Conscious Investor

Wizard, is leading the way as Fourth Generation Investment

Software.

Dr. John Price has personally programmed almost

20 different stock valuation methods. Next he studied and

evaluated them all. As a starting point for Conscious Investor

he chose the best ideas and then added many layers of research-proven

developments and user-friendly innovations.

The final system combines the best of the

high-speed calculation abilities of modern computers, the

efficient management of stock market databases, and the

advanced functionality of an expert system that provides

analysis, knowledge and guidance at the touch of a button.

No matter whether you are new to investing

or are an experienced professional, Conscious Investor provides

everything that is required.

For new investors Conscious Investor

is there to “hold your hand”. For example, it

provides automatic explanations in plain English for key

charts. These include descriptions and recommendations for

further steps leading to an analysis of whether to buy,

to sell or to do nothing under historical and safety settings.

For experienced professionals it is a total system. It ranges

from scanning individual sectors or the whole market using

default or user-modified research-proven filters through

to the calculation and analysis of the profitability of

the stock under various safety and risk scenarios.

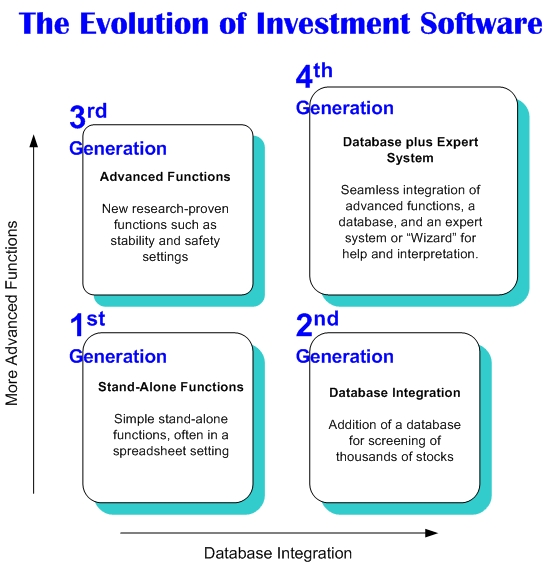

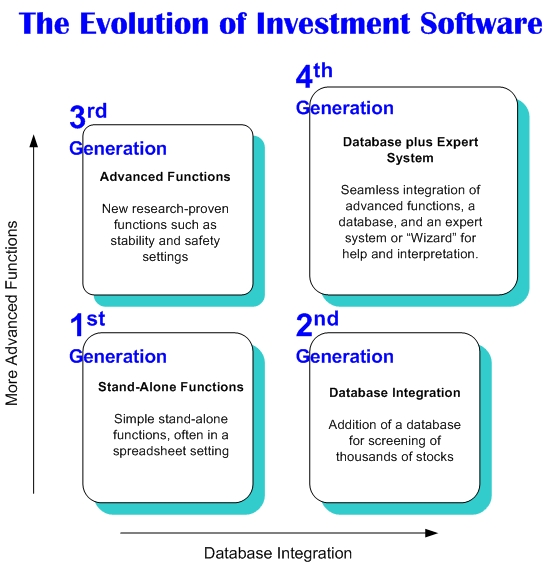

1st Generation:

The first applications of computers to the stock market

were to calculate standard well-known functions involved

with the analysis and evaluation of equities. There was

no associated database with the functions often working

in a spreadsheet setting.

2nd Generation:

This was the phase where databases involving fundamental

and price data were integrated with calculation systems.

This enabled the filtering or screening of thousands of

stocks leading to an output of a small number of companies.

The screening was done using various combinations of functions

and measurements from the first level. Weighting to combine

the measures into a single overall statistic for ranking

purposes may be used.

3rd Generation:

A thorough analysis of the functions in the first level

showed their inadequacies and weaknesses. This third phase

added completely new research-proven functions specifically

designed to identify quality investments such as stability

of growth and to introduce automatic safety settings for

increased security.

4th Generation:

Conscious Investor This starts with all the best

features from the previous three levels including valuation

methods that are theoretically sound and thoroughly back-tested.

Then it integrates in a seamless way an expert system that

• guides and helps at all key points with just a click

of the Wizard’s wand,

• describes and interprets key charts in plain English,

and

• thoroughly analyzes whether it is best to buy, sell

or do nothing under historical, safety and user-defined

settings.

|